You should buy a far greater rate on the Financial out of Asia to own a smaller tenor — step three.00% p.a. Is not high after all, OCBC provides was able seemingly lower fixed put prices over the past several months anyhow. Given that almost every other banking institutions have slash theirs, OCBC’s has gone out of lower to help you kinda mediocre. Price, you really must have a qualified Maybank deals account otherwise most recent membership. For each and every $step one,100 from the membership (at least $2,000), you could lay $ten,100000 into the repaired deposit (minimal $20,000). Malaysian bank CIMB provides very average repaired deposit prices inside Singapore it month, during the to dos.70% p.an excellent.

Modified Visibility Limitations to have Trust Profile

Within the authorities’s Monetary Claims Strategy (FCS), places are secure around $250,one hundred thousand for every account holder at each and every bank, building people or credit connection, in addition to places having any other banking companies they efforts lower than a good some other change term. Aspiring to make some interest to the a deposit more than $one million? Contrast and you will estimate interest rates, efficiency, charges and much more for a range of label places, and get the ideal identity deposit for your economic demands. Although not, for many who’re also trying to put $20,000 or more to the a fixed deposit, the present day DBS cost are a flat, unimpressive 0.05% p.a good. DBS left the repaired put cost consistent through the 2024, having rates of up to step 3.20% p.a good.

Navigating Changes in FDIC Insurance rates: Guaranteeing Put Defense Amidst Modified Limits

- Faith Profile are dumps kept by no less than one people below either an informal revocable faith (e.grams., Payable to your Dying (POD) and in Faith To have (ITF) accounts), an official revocable faith, or an enthusiastic irrevocable trust.

- Price we watched during the early January 2024, however, isn’t of up to the brand new four percent we saw inside the December 2023.

- You can even build deductible efforts to a timeless IRA as the a lot of time as your money is not too high on exactly how to qualify.

- With the absolute minimum put requirement of $20,one hundred thousand — somewhat to the large front compared to the almost every other financial institutions.

- Sweepstakes gambling enterprises try courtroom inside forty-five+ claims (incl. Ca, Tx, Nyc, and FL) and offer actual gambling games with an opportunity to win dollars honors.

To own the absolute minimum put level of $fifty,one hundred thousand and you will a connection period of three or half dozen days. That’s off by 0.05% because their advertising and marketing rates in the October, that happen to be along with down 0.10% from the costs in the September. The state Financial out of Asia (SBI) Singapore has an excellent marketing and advertising fixed deposit price it day away from 3.55 % p.a great.. To enjoy that it price, you should set at the least $50,000 having SBI for a time period of half a dozen days — a pretty great deal, but at the least the time frame isn’t a long time. Is amongst the large fixed deposit costs which few days one of banking companies inside the Singapore.

Options Bank away from Montana will pay $31,000 to have ton insurance rates violations

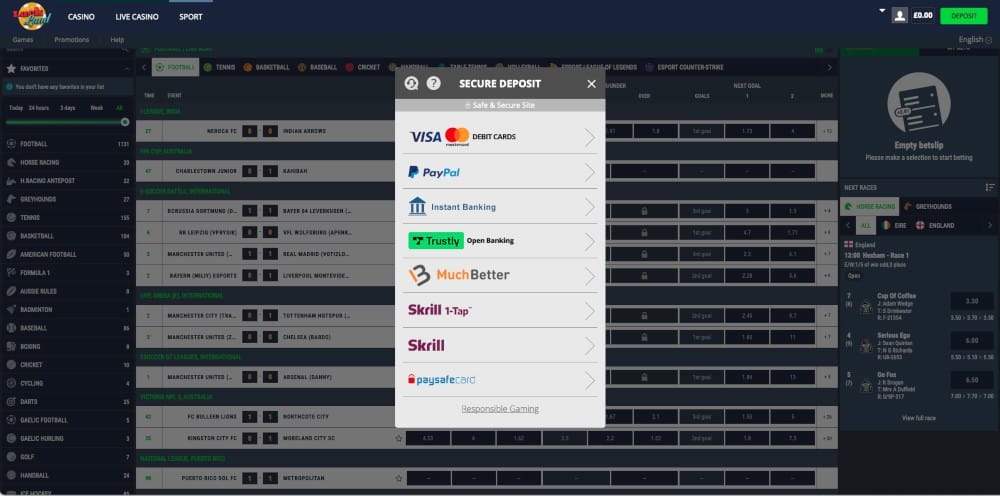

Really no-put incentive also offers provides limitation win and you may detachment constraints. Thus even if you hit a mrbetlogin.com necessary hyperlink great seven-contour commission on the a progressive jackpot, the amount your cash-out might possibly be capped. For many who’lso are stating 100 percent free spins, you’ll be restricted to a short set of qualified video game.

The lending company often waive their fees if you care for a particular minimum on the membership. Once you’ve a qualifying medical care bundle, shop around a variety of banking institutions otherwise funding accounts that provide HSAs. We wrote a blog post concerning the procedure of beginning a keen HSA membership, and this bank I chose, and just why. The utmost yearly contribution depends on whether you are for the an enthusiastic private or loved ones plan.

In the 2024, somebody is also lead $4,3 hundred and you will families is contribute $8,550. For individuals who’re also 55 otherwise elderly, you possibly can make $step 1,one hundred thousand in the catch-up benefits. For those who’re looking an almost risk-free investment car, you’re also destined to attended across fixed places, Singapore Discounts Ties (SSB) and Treasury debts (T-bills). We’re assured they’ll be back which have some other strategy soon that have greatest prices. When the its Xmas promotion is almost anything to go-by, they may be a prices as well — in the December 2023, you can enjoy up to step 3.65 % p.a great.

Maybank repaired put cost

It gets one a similar lay but means you to definitely dive because of even more hoops. Although not, when the either you or your wife is included by the a workplace retirement bundle, eligibility for allowable efforts in order to a vintage IRA starts to stage out from the higher money profile. In case your money is actually higher on exactly how to generate deductible efforts, you might still generate nondeductible contributions up to the fresh yearly limit. For each and every partner try permitted to contribute to the modern yearly limitation. Yet not, full shared benefits never go beyond the new nonexempt compensation advertised to the joint income tax get back.

2 Means of Placing Fund And ultizing Lead Pay

Understanding the interplay anywhere between provided problems plus the collateral resource code is essential to own a precise assessment of your own prospective healing inside an injury otherwise medical malpractice suit. For example, within the condition A good, non-economic damage inside the injury times can be capped from the $five hundred,one hundred thousand, while condition B will most likely not impose any cap, and therefore enabling a jury so you can award as much as they find match, in accordance with the evidence shown. It is very important understand the certain wreck limits one pertain for the state in order to correctly assess the prospective property value their allege. From the realm of injury and scientific malpractice times, ruin limits is statutory limitations placed on the level of payment one to an excellent claimant is going to be given for certain form of problems. These damage caps vary significantly by the condition, with says imposing tight damage hats, and others features high limits or no hats at all. Vanessa Nah pencils articles to the ins and outs of purchasing your first home, the brand new T&Cs out of playing cards, and the highs and lows out of choice assets.

Basically, they are available because the a deposit suits otherwise fee bonuses. Including, for those who have a good $20 bonus that have a great 1x betting needs, you ought to play as a result of $20 before withdrawing. You need to perform an alternative Risk.all of us Gambling establishment membership to claim so it strategy. Stake.us has many constant advertisements due to its popular Stake United states incentive drop code program which includes daily added bonus packages, a regular raffle, and multiplier falls to boost their bankroll. You must earn no less than a hundred South carolina ahead of redeeming for money honours (at the very least fifty Sc to have provide cards).

Employees are allowed to make benefits out of their salaries out of around $16,one hundred thousand inside 2024. Staff over the age of fifty qualify to make connect-upwards efforts as high as $3,five hundred in 2024 and you can 2025. A good nonworking individual that documents a shared taxation go back using their companion even offers the choice to subscribe to a great spousal IRA for as long as the companion provides gained adequate nonexempt income so you can defense IRA efforts made for one another. You will find an enthusiastic aggregate limitation to the count you might contribute to help you a traditional and you will Roth IRA. To possess 2024, it is $7,100 for these younger than simply fifty, when you’re connect-up efforts give the fresh limitation as much as $8,100000 for those fifty and you may older.

The highest board rates you’ll arrive at appreciate are 2.25% p.a great., which is not higher anyway. One drawback out of Citibank’s fixed deposit would it be’s never available—in spite of the seemingly short connection periods, $fifty,100 is an enormous amount of money. Within the current legislation, trust dumps are actually capped from the $step 1.twenty five million within the FDIC visibility for each and every faith manager for every insured depository institution. Within the faith, per beneficiary is eligible to possess insurance policies as much as $250,100000, appropriate for up to five beneficiaries.

An identical things connect with the newest Spouse’s single membership deposits. Since the Paul entitled a couple of qualified beneficiaries, his limitation insurance coverage is $five hundred,000 ($250,000 x dos beneficiaries). As the his display of Membership 1 ($350,000) is less than $500,100000, he’s completely covered. FDIC insurance rates covers deposits received during the an insured bank, but cannot defense investment, even when these people were purchased at an insured bank.